Understanding the difference between travel insurance and health insurance takes center stage in this informative guide. Delve into the nuances of these two essential types of insurance with a mix of clarity and depth.

Get ready to explore the distinct features, coverage, and benefits that travel insurance and health insurance offer, ensuring you make informed decisions when it comes to protecting yourself while traveling.

Understanding Travel Insurance

Travel insurance is a type of insurance coverage that can provide protection for unexpected events that may occur during a trip. It typically covers a range of situations to help travelers avoid financial losses or receive assistance when facing emergencies.

What Travel Insurance Typically Covers

- Trip Cancellation or Interruption: Reimbursement for non-refundable trip expenses if you need to cancel or cut your trip short due to covered reasons.

- Emergency Medical Expenses: Coverage for medical treatment, hospital stays, or emergency medical evacuation while traveling.

- Lost or Delayed Baggage: Reimbursement for belongings lost, stolen, or delayed during your trip.

- Travel Delay: Compensation for additional expenses due to unexpected travel delays.

- Emergency Assistance Services: 24/7 support for medical emergencies, legal assistance, or other travel-related issues.

Examples of Situations Where Travel Insurance Can Be Beneficial

Travel insurance can be beneficial in various situations, such as:

- Unexpected illness or injury while traveling abroad and needing medical care.

- Cancellation of a trip due to a family emergency or natural disaster.

- Losing your luggage or having important travel documents stolen during your trip.

- Flight delays causing you to miss connecting flights or requiring an unplanned stay at a hotel.

The Importance of Travel Insurance for International Travel

When traveling internationally, the importance of having travel insurance becomes even more critical. Healthcare costs and emergency services can vary significantly from one country to another, and having the right coverage can provide peace of mind and financial protection in case of unforeseen events. It is essential to choose a travel insurance policy that suits your needs and covers the destinations you plan to visit.

Understanding Health Insurance

Health insurance is a type of coverage that pays for medical and surgical expenses incurred by the insured. The primary purpose of health insurance is to provide financial protection against high medical costs, ensuring that individuals can access necessary healthcare without facing significant financial burden.

When comparing health insurance with travel insurance, it is important to note that health insurance typically covers medical expenses related to illness, injury, or preventive care, while travel insurance focuses on providing coverage for trip cancellation, lost luggage, emergency evacuation, and other travel-related risks. Health insurance is designed to provide long-term coverage for healthcare needs, while travel insurance is more short-term and specific to travel-related incidents.

In different scenarios, health insurance offers coverage for a wide range of medical services, including hospital stays, surgeries, prescription medications, doctor visits, preventive care, and more. Health insurance policies may vary in terms of coverage limits, deductibles, copayments, and network restrictions, so it is essential to carefully review the details of your policy to understand what is covered and what is not.

Coverage of Health Insurance in Different Scenarios

- Emergency Room Visits: Health insurance typically covers emergency room visits for sudden illness or injury, but the coverage may vary depending on the policy.

- Hospital Stays: Health insurance provides coverage for hospital stays, including room charges, surgeries, and other medical services required during the hospitalization.

- Prescription Medications: Many health insurance plans include coverage for prescription medications, with varying levels of copayments or coinsurance.

- Preventive Care: Health insurance often covers preventive services such as vaccinations, screenings, and annual check-ups to help maintain overall health and detect potential health issues early.

- Specialized Treatments: Some health insurance plans may cover specialized treatments or therapies for chronic conditions, mental health services, maternity care, and other specific healthcare needs.

Key Differences Between Travel Insurance and Health Insurance

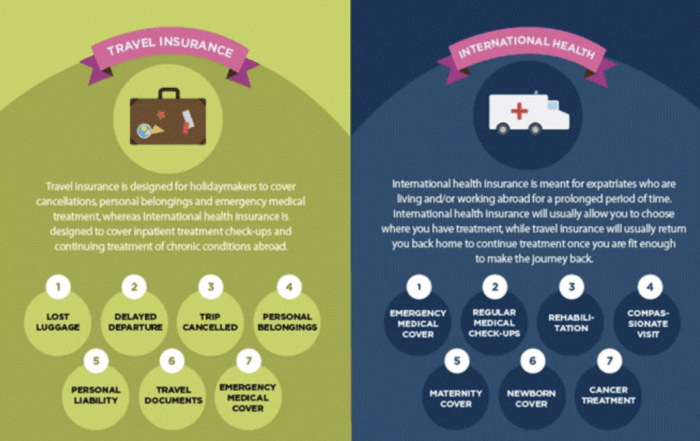

Travel insurance and health insurance serve different purposes and offer distinct coverage options. While travel insurance focuses on trip-related issues, health insurance is designed to cover medical expenses. Let’s explore the key differences between these two types of insurance.

Coverage Differences

- Travel Insurance: Provides coverage for trip cancellations, delays, lost luggage, emergency evacuation, and medical emergencies while traveling.

- Health Insurance: Offers coverage for medical expenses, doctor visits, hospital stays, prescription drugs, and preventive care.

Cost Factors

Travel insurance premiums are typically lower than health insurance premiums since they cover a shorter duration and specific risks associated with travel. Health insurance, on the other hand, involves higher costs due to comprehensive coverage for ongoing medical needs.

When planning international travel for seniors, it’s crucial to consider getting international travel insurance to ensure their safety and peace of mind throughout the trip.

When to Have Both Types of Insurance

- Traveling Abroad: Having both travel insurance and health insurance is recommended when traveling abroad to ensure coverage for trip-related issues and medical emergencies.

- Pre-existing Conditions: If you have pre-existing health conditions, it’s advisable to have both types of insurance to address any medical needs during travel.

- Adventure Travel: Engaging in high-risk activities during travel may require additional coverage from both travel and health insurance plans.

Importance of Having Both Types of Insurance

Having both travel insurance and health insurance can provide comprehensive coverage for various scenarios that may arise during your travels.

Comprehensive Coverage

- Travel insurance typically covers trip cancellations, lost baggage, and emergency medical expenses while abroad.

- Health insurance, on the other hand, covers routine medical care, pre-existing conditions, and hospitalizations in your home country.

- By having both types of insurance, you can ensure that you are protected no matter where you are traveling or what unexpected situations you may encounter.

Real-Life Examples

- Imagine you are on a trip to a remote destination and you suddenly fall ill. With travel insurance, you can get emergency medical treatment and evacuation if needed. However, for ongoing care once you return home, your health insurance will cover the expenses.

- In another scenario, if your flight is canceled due to bad weather and you need to rebook your trip, travel insurance can reimburse you for the costs. But if you require medical attention during the trip, your health insurance will cover those expenses.

Complementary Coverage, Understanding the difference between travel insurance and health insurance

- Travel insurance is essential for covering travel-specific risks like trip interruptions and lost baggage, while health insurance provides coverage for your overall health and wellness.

- Having both types of insurance ensures that you are adequately protected whether you are traveling domestically or internationally, for leisure or business purposes.

Wrap-Up: Understanding The Difference Between Travel Insurance And Health Insurance

As we conclude this exploration of travel insurance and health insurance, it’s clear that both types of insurance play crucial roles in safeguarding your well-being during domestic and international travels. By understanding the nuances of each, you can make wise choices to ensure comprehensive coverage in various scenarios.

Regularly checking and refilling your car’s brake fluid is essential for maintaining optimal brake performance. Learn how to check and refill your car’s brake fluid to keep your vehicle safe on the road.