Tips for buying travel insurance online sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with informal but serious style and brimming with originality from the outset.

When it comes to safeguarding your travel adventures, buying the right insurance online can make all the difference. From researching options to understanding policy coverage, this guide will equip you with the essential knowledge to make informed decisions.

Researching Travel Insurance

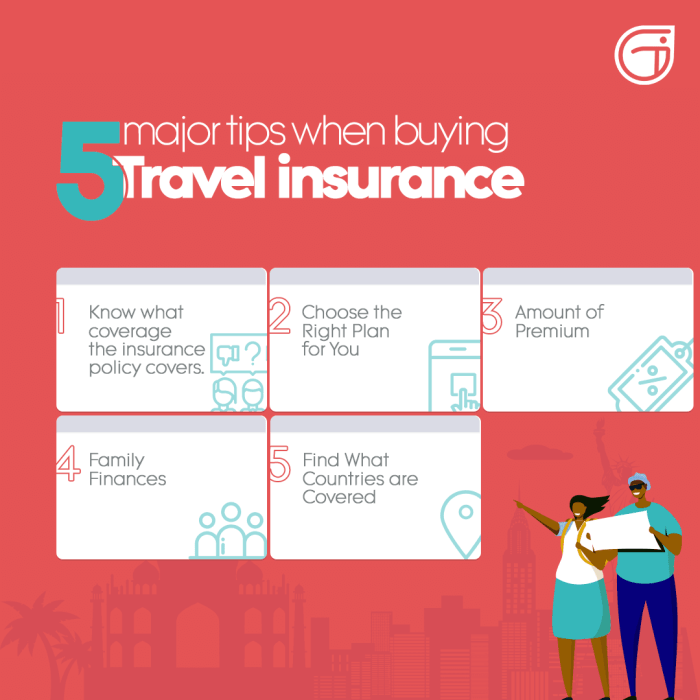

When it comes to buying travel insurance online, researching different options is crucial to ensure you get the right coverage at the best price. Here are some tips to help you navigate through the process:

Comparing Coverage and Prices

- Start by making a list of what you need coverage for, such as trip cancellation, medical emergencies, or lost baggage.

- Visit multiple travel insurance websites to compare the coverage options they offer. Look for policies that meet your specific needs.

- Check the limits and exclusions of each policy to understand what is covered and what is not.

- Consider the deductible amount and how it may affect the overall cost of the policy.

- Don’t just focus on the price – make sure the coverage provided is adequate for your travel plans.

Key Factors to Consider

- Read reviews and ratings of different insurance providers to gauge their reputation and customer service.

- Check the claim process and customer support options in case you need assistance during your trip.

- Look for any additional benefits offered, such as coverage for adventure activities or pre-existing medical conditions.

- Consider the length of your trip and whether you need a single-trip or annual multi-trip policy.

- Make sure the policy includes coverage for trip cancellations due to unforeseen events like illness or natural disasters.

Understanding Policy Coverage

When purchasing travel insurance, it is crucial to understand the policy coverage to ensure you are adequately protected during your trip. Here is an overview of the common coverage types in travel insurance and the exclusions and limitations you should be aware of.

Common Coverage Types

- Medical expenses coverage: This includes coverage for emergency medical treatment and evacuation during your trip.

- Trip cancellation/interruption coverage: Reimburses you for non-refundable trip costs if you have to cancel or cut your trip short due to covered reasons.

- Baggage loss/delay coverage: Provides reimbursement for lost, stolen, or delayed baggage during your trip.

- Travel delay coverage: Offers compensation for additional expenses incurred due to travel delays, such as accommodation and meal costs.

Exclusions and Limitations

- Pre-existing conditions: Many policies do not cover pre-existing medical conditions unless specified in the policy.

- High-risk activities: Some policies exclude coverage for activities like extreme sports or certain adventurous activities.

- Travel to high-risk destinations: Certain destinations deemed high-risk may not be covered under standard travel insurance policies.

- Alcohol or drug-related incidents: Coverage may be excluded for incidents related to alcohol or drug use.

Reading the Fine Print

It is essential to carefully read the fine print of your travel insurance policy to understand the coverage, exclusions, and limitations. Pay attention to details such as coverage amounts, deductible amounts, and specific conditions for coverage. Being aware of what is and isn’t covered can prevent any surprises or misunderstandings during your travels.

Assessing Travel Needs: Tips For Buying Travel Insurance Online

When it comes to buying travel insurance, it’s crucial for travelers to assess their specific needs to ensure they have adequate coverage. Factors such as destination, activities planned, duration of travel, and medical history all play a role in determining the right insurance policy.

Destination

- Consider the destination’s healthcare system and the cost of medical treatment there.

- Some countries may require specific coverage for entry, like Schengen visa countries.

- Look into the level of safety and security in the area to assess the risk of theft or accidents.

Activities

- Adventure activities like skiing, scuba diving, or hiking may require additional coverage.

- Check if your policy covers activities you plan on doing during your trip.

- Extreme sports or activities with a higher risk of injury may need specialized coverage.

Duration of Travel

- Short trips may only require basic coverage, while long-term travel may need more comprehensive insurance.

- Consider the likelihood of trip delays, cancellations, or interruptions based on the length of your stay.

- Look into coverage for missed connections or emergency evacuations in case of longer trips.

Medical History

- Pre-existing medical conditions may require additional coverage or a specialized policy.

- Be honest about your medical history to ensure you are adequately covered in case of any health-related issues.

- Check if your policy includes coverage for medical emergencies and repatriation in case of illness or injury.

Reviewing Customer Reviews and Ratings

When buying travel insurance online, it’s crucial to review customer reviews and ratings of different insurance providers. These reviews offer valuable insights into the quality of service, claim processes, and overall customer satisfaction levels. By taking the time to read through feedback from actual customers, you can make a more informed decision and choose a reliable insurance provider for your travel needs.

Tips for Discerning Genuine Feedback

- Look for detailed reviews that provide specific information about the customer’s experience with the insurance provider.

- Check for consistency in feedback across multiple reviews to get a more accurate representation of the provider’s service quality.

- Beware of overly positive or negative reviews that seem biased or manipulated.

- Consider the overall rating and the number of reviews to gauge the general sentiment towards the insurance provider.

Role of Customer Experiences in Decision Making

- Customer reviews and ratings help you understand how the insurance provider handles claims, customer inquiries, and emergencies.

- Real-life experiences shared by customers can give you a glimpse of what to expect in terms of customer service and support.

- Positive reviews can instill confidence in the insurance provider, while negative reviews can alert you to potential red flags or issues to consider.

Understanding Claims Process

When it comes to purchasing travel insurance, understanding the claims process is crucial. Knowing how to file a claim, what documents are needed, and how to make the process smoother can save you time and stress in the event of an emergency during your trip.

Steps to File a Claim

- Notify your insurance provider as soon as possible: In case of an emergency, contact your insurance company immediately to inform them about the situation.

- Complete the claim form: Fill out the necessary paperwork accurately and provide all required information.

- Gather supporting documents: Collect any relevant documents such as receipts, medical reports, police reports, and proof of travel.

- Submit the claim: Send all the documents to your insurance provider either online or through mail, following their specific instructions.

- Follow up: Stay in touch with your insurance company to track the progress of your claim and provide any additional information if needed.

Importance of Understanding Claims Process, Tips for buying travel insurance online

Understanding the claims process before purchasing a policy can help you make an informed decision. Knowing what to expect in case of an emergency can give you peace of mind and ensure that you are adequately covered during your travels.

When it comes to annual travel insurance for frequent travelers, it’s essential to find a reliable policy that offers comprehensive coverage at a reasonable price. With annual travel insurance for frequent travelers , you can enjoy peace of mind knowing that you’re protected throughout all your adventures.

Tips for a Smooth Claims Process

- Read the policy carefully: Familiarize yourself with the terms and conditions of your policy to avoid any surprises when filing a claim.

- Keep all receipts: Save all receipts related to your trip expenses as they may be required as proof when filing a claim.

- Contact your insurance provider promptly: Don’t delay in notifying your insurance company about any incidents that may lead to a claim.

- Be honest and provide accurate information: Ensure that all the information you provide when filing a claim is truthful and accurate to avoid any delays or complications.

- Follow the instructions: Adhere to the guidelines provided by your insurance provider to ensure a smooth and efficient claims process.

Considering Emergency Assistance Services

When it comes to travel insurance, emergency assistance services play a crucial role in providing travelers with support and resources during unforeseen situations or emergencies while traveling.

Types of Emergency Assistance Services

- 24/7 emergency hotline: A dedicated phone line that travelers can call in case of emergency for immediate assistance and guidance.

- Medical evacuation: Arrangements for transportation to the nearest adequate medical facility in case of a medical emergency that requires specialized care.

- Repatriation of remains: Assistance in arranging for the return of the deceased traveler’s remains to their home country in case of a tragic event.

- Legal assistance: Help with legal matters such as lost or stolen travel documents, legal representation in a foreign country, or dealing with authorities.

Benefits of Emergency Assistance Services

Emergency assistance services can be a lifesaver in critical situations, providing travelers with the necessary support, resources, and guidance to navigate through challenging circumstances.

Examples of Emergency Assistance Services in Action

Imagine you fall ill during your trip and require immediate medical attention beyond what is available locally. With medical evacuation coverage, you can be transported to a facility equipped to handle your medical needs, ensuring you receive the care you require.

In another scenario, you lose your passport while traveling abroad. With access to a 24/7 emergency hotline for assistance, you can quickly get guidance on how to proceed, obtain a replacement, and navigate the necessary procedures to continue your journey smoothly.

Conclusion

As you embark on your journey to purchase travel insurance online, remember these key tips and insights. Whether it’s assessing your travel needs or understanding the claims process, this guide has provided you with a roadmap to navigate the world of online travel insurance with confidence. Bon voyage and safe travels!

Looking for compact cars with spacious interior? Look no further! Check out the latest models that offer the perfect combination of size and comfort. With compact cars with spacious interior , you can enjoy a comfortable ride without compromising on space.