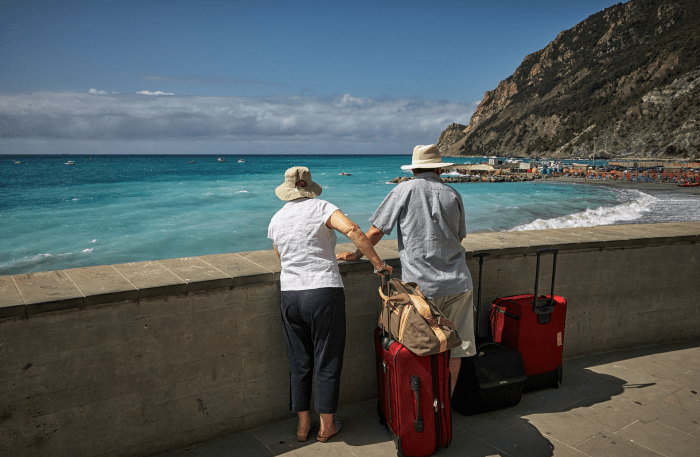

International travel insurance for seniors is a critical aspect of planning any trip for older adults. From providing essential coverage to peace of mind, this type of insurance can be a game-changer when exploring new destinations. Let’s dive into the key details that seniors need to know about international travel insurance.

Importance of International Travel Insurance for Seniors

Travel insurance is crucial for seniors embarking on international trips due to the unique risks and challenges they may face. It provides peace of mind and financial protection in unforeseen circumstances, ensuring a safe and stress-free journey.

Key Benefits of International Travel Insurance for Seniors

- Medical Coverage: International travel insurance covers emergency medical expenses, hospital stays, and repatriation in case of illness or injury while abroad. This is especially important for seniors with pre-existing medical conditions.

- Trip Cancellation/Interruption: Seniors may need to cancel or cut short their trip due to various reasons like health issues, family emergencies, or flight cancellations. Travel insurance reimburses the non-refundable expenses incurred.

- Lost Baggage and Personal Belongings: Seniors can be easy targets for theft or loss of luggage. Travel insurance provides coverage for lost, stolen, or damaged belongings during the trip.

- Emergency Assistance Services: Seniors can access 24/7 emergency assistance services for medical referrals, translation services, legal assistance, and other travel-related help.

Examples of Situations where International Travel Insurance is a Lifesaver for Seniors

- A senior traveler falls ill and requires hospitalization in a foreign country. Without travel insurance, the medical expenses could be exorbitant and burdensome.

- Due to unforeseen circumstances, a senior has to cancel their trip at the last minute. Travel insurance helps recover the prepaid costs for flights, accommodations, and tours.

- A senior’s luggage gets lost during a layover, containing essential medication and personal items. Travel insurance covers the cost of replacing the lost belongings.

Coverage Options for Seniors

When it comes to international travel insurance for seniors, there are various coverage options available to ensure their safety and well-being during their trips. It is important for seniors to carefully consider the different types of coverage to choose the one that best suits their needs and provides adequate protection.

Types of Coverage Options

- Medical Coverage: This type of coverage includes expenses related to medical emergencies, hospital stays, and medical evacuation.

- Trip Cancellation/Interruption: Seniors can opt for coverage that reimburses non-refundable trip costs in case of trip cancellation or interruption due to unforeseen events.

- Baggage Loss/Theft: Coverage for lost, stolen, or damaged baggage can be beneficial for seniors traveling with valuable belongings.

- Emergency Assistance Services: This coverage provides access to 24/7 emergency assistance services, such as medical referrals and translation services.

Limitations of Coverage, International travel insurance for seniors

- Pre-existing Conditions: Some international travel insurance policies for seniors may have limitations or exclusions related to pre-existing medical conditions.

- Age Restrictions: Seniors may encounter age restrictions or limitations on coverage based on their age when purchasing travel insurance.

- Exclusions: It is important for seniors to carefully review the policy exclusions to understand what is not covered by their insurance plan.

Comprehensive Coverage vs. Basic Coverage

Seniors have the option to choose between comprehensive coverage and basic coverage when selecting an international travel insurance plan. Here is a comparison of the two:

| Comprehensive Coverage | Basic Coverage |

|---|---|

| Provides extensive coverage for various travel-related risks and incidents. | Offers limited coverage for essential travel needs such as medical emergencies. |

| Includes benefits such as trip cancellation/interruption, baggage loss/theft, and emergency assistance. | May have fewer benefits and lower coverage limits compared to comprehensive plans. |

| Generally more expensive but provides greater peace of mind and protection. | Cost-effective option for seniors looking for basic coverage during their travels. |

Factors to Consider When Choosing a Policy: International Travel Insurance For Seniors

When seniors are selecting an international travel insurance policy, there are several key factors they should consider to ensure they have adequate coverage for their trip.

Pre-Existing Medical Conditions

Seniors should carefully review how pre-existing medical conditions are covered under the insurance policy. Some policies may exclude coverage for pre-existing conditions, while others may offer limited coverage or require additional premiums. It’s important for seniors to disclose all medical conditions upfront and understand how they will be covered during their travels.

Trip Cancellation Coverage

Trip cancellation coverage is crucial for seniors, as unforeseen circumstances such as illness, injury, or natural disasters can force them to cancel their travel plans. Seniors should check if the insurance policy provides coverage for trip cancellations and what reasons are considered valid for cancellation. This coverage can help seniors recoup their non-refundable trip expenses in case they need to cancel their trip unexpectedly.

Tips for Finding Affordable Insurance

Finding affordable international travel insurance for seniors is crucial to ensure peace of mind during trips without breaking the bank. Here are some tips on how seniors can find affordable insurance without compromising on coverage.

Role of Age and Destination in Determining Insurance Costs

Age and destination play a significant role in determining insurance costs for seniors. Insurance companies often consider age as a risk factor, as older individuals may have more health issues. Additionally, the destination can impact costs based on factors such as healthcare expenses, safety concerns, and travel risks. It’s essential for seniors to be aware of how age and destination can influence insurance costs when looking for affordable options.

Benefits of Bundling Insurance Policies

One way seniors can save on travel insurance costs is by bundling insurance policies. By combining different types of insurance, such as health insurance, auto insurance, and travel insurance, seniors may qualify for discounts or lower premiums. Bundling can help seniors save money while ensuring they have comprehensive coverage for their travel needs.

Final Conclusion

In conclusion, international travel insurance for seniors offers a safety net and peace of mind during trips abroad. By understanding the importance of coverage options and factors to consider, older adults can embark on their adventures with confidence. Stay safe and enjoy your travels!

When embarking on long-term trips, it’s crucial to secure travel insurance for long-term trips to protect yourself from unexpected situations. From flight cancellations to medical emergencies, having the right coverage can give you peace of mind throughout your journey.

Looking for a reliable vehicle for your travels? Consider exploring compact cars with spacious interiors that offer both comfort and efficiency on the road. These vehicles are perfect for long drives and can accommodate your luggage without compromising on legroom.