Starting with How to compare travel insurance plans, this guide will help you navigate the complexities of choosing the right travel insurance policy.

Exploring the key features, coverage options, pricing factors, and claim processes, you’ll be equipped with the knowledge to make an informed decision.

Factors to Consider when Comparing Travel Insurance Plans

When comparing travel insurance plans, it is crucial to consider a few key factors to ensure you get the coverage that fits your needs. Understanding the importance of coverage limits, exclusions, and the difference between comprehensive and basic coverage can help you make an informed decision.

Key Features to Look for in a Travel Insurance Plan

- Medical Coverage: Ensure the plan provides adequate coverage for medical emergencies, including hospital stays, doctor visits, and emergency medical evacuations.

- Trip Cancellation and Interruption: Look for coverage that reimburses you for non-refundable trip expenses in case you need to cancel or cut short your trip due to unforeseen circumstances.

- Baggage Loss/Delay: Check if the plan offers coverage for lost, stolen, or delayed baggage to reimburse you for essential items you may need while traveling.

- Emergency Assistance Services: Consider plans that provide 24/7 emergency assistance services for help with medical emergencies, travel arrangements, or other unforeseen events during your trip.

Importance of Coverage Limits and Exclusions in Insurance Policies

- Coverage Limits: Pay attention to the maximum limits on coverage for different benefits, such as medical expenses, trip cancellation, or baggage loss, to ensure they meet your travel needs.

- Exclusions: Understand what is not covered by the insurance policy, such as pre-existing medical conditions, high-risk activities, or certain destinations, to avoid any surprises when filing a claim.

Benefits of Comprehensive Coverage versus Basic Coverage

- Comprehensive Coverage: Offers broader protection with higher coverage limits and additional benefits, such as cancel for any reason coverage or coverage for adventure activities.

- Basic Coverage: Provides essential coverage for common travel risks like trip cancellations, medical emergencies, and baggage loss, but may have lower coverage limits and fewer benefits compared to comprehensive plans.

Coverage Options in Travel Insurance Plans

When comparing travel insurance plans, it’s essential to understand the different coverage options available to ensure you have adequate protection for your specific travel needs.

Medical Coverage

- Provides coverage for medical expenses incurred during your trip, including hospital stays, doctor visits, and emergency medical evacuation.

- Check the coverage limits and exclusions, as well as whether pre-existing conditions are covered.

Trip Cancellation Coverage

- Reimburses you for prepaid, non-refundable trip costs if you have to cancel your trip due to covered reasons, such as illness, natural disasters, or other emergencies.

- Review the covered reasons and the percentage of trip costs reimbursed.

Baggage Loss Coverage

- Compensates you for lost, stolen, or damaged baggage during your trip.

- Check the limits on reimbursement per item and total coverage amount.

Optional Coverage

- Consider adding optional coverage for activities like adventure sports, rental car protection, or cancel for any reason (CFAR) coverage.

- Assess the additional cost of optional coverage and determine if it aligns with your travel plans and potential risks.

Pricing and Premiums of Travel Insurance Plans: How To Compare Travel Insurance Plans

When comparing travel insurance plans, understanding the pricing and premiums is crucial to finding the best coverage that suits your needs without breaking the bank.

Factors Influencing Pricing of Travel Insurance Plans

- Destination: Some countries or regions may have higher risks of medical emergencies, theft, or natural disasters, impacting the cost of insurance.

- Trip Duration: Longer trips typically result in higher premiums due to an increased likelihood of incidents over an extended period.

- Age of Traveler: Older travelers may face higher premiums as they are considered more at risk for health issues.

- Coverage Limits: Plans with higher coverage limits for medical expenses, trip cancellations, or baggage loss may come with higher premiums.

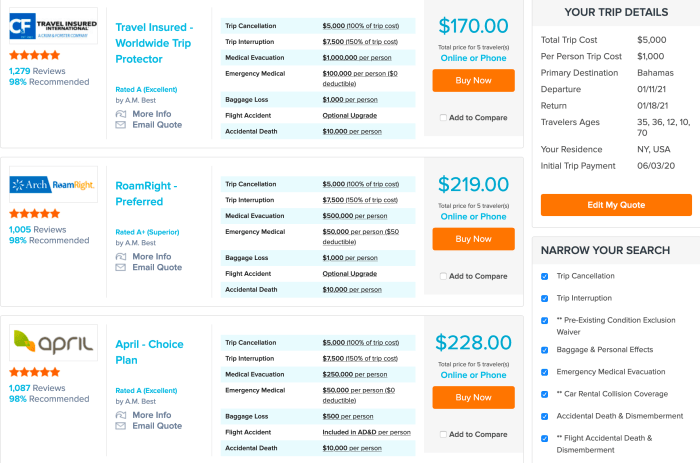

Tips on Comparing Premiums Between Different Insurance Providers

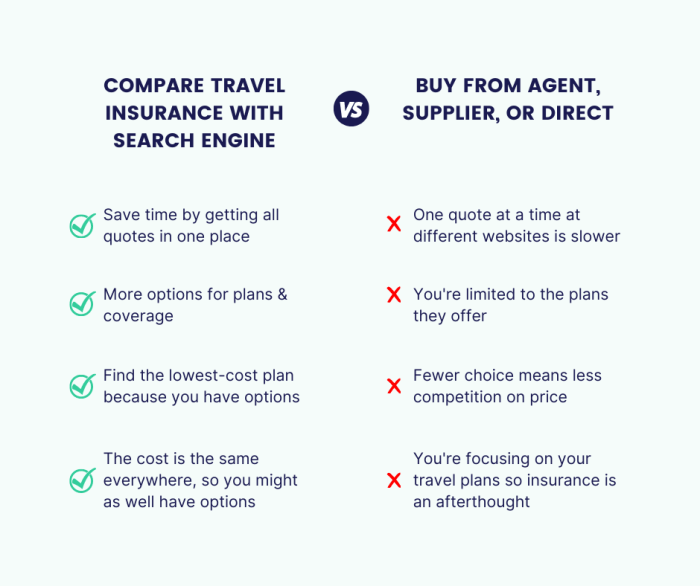

- Request Quotes: Obtain quotes from multiple insurance providers to compare premiums and coverage options side by side.

- Consider Bundling: Some insurance companies offer discounts when you bundle travel insurance with other policies like auto or home insurance.

- Check for Discounts: Look for discounts based on factors like age, membership in certain organizations, or a good travel history.

Strategies to Balance Cost with Coverage When Selecting a Travel Insurance Plan

- Assess Your Needs: Determine what coverage is essential for your trip and prioritize those aspects when selecting a plan.

- Opt for Essentials: Choose a plan that covers the essentials like emergency medical care, trip cancellations, and baggage loss without unnecessary add-ons.

- Compare Deductibles: Higher deductibles typically result in lower premiums, but make sure you can afford the deductible in case of a claim.

Claim Process and Customer Support

When it comes to travel insurance, a smooth and efficient claim process is crucial. It ensures that in case of an emergency or unforeseen event during your trip, you can easily file a claim and receive the necessary assistance and coverage.

Comparison of Customer Support Services

- 24/7 Assistance: Look for insurance companies that offer round-the-clock customer support to assist you anytime, anywhere.

- Multiple Contact Channels: Evaluate if the insurance provider offers various contact options such as phone, email, and online chat for easy communication.

- Claim Tracking: Check if the company provides a platform for you to track your claim status online for transparency and peace of mind.

Evaluating Reputation and Reliability, How to compare travel insurance plans

Research customer reviews and ratings to gauge the reputation of insurance providers in handling claims efficiently and fairly.

- Check for Accreditations: Look for insurance companies with industry certifications and accreditations, indicating their reliability and adherence to quality standards.

- Claim Settlement Ratio: Consider the claim settlement ratio of insurance companies, which reflects their track record of settling claims promptly and satisfactorily.

- Customer Feedback: Pay attention to customer feedback and experiences shared online or through word of mouth to assess the overall reliability of the insurance provider.

Closing Notes

In conclusion, comparing travel insurance plans is crucial to ensure you have adequate coverage for your travels. By considering all the factors discussed, you can select a plan that meets your needs and provides peace of mind during your journey.

When it comes to keeping your car’s interior clean and fresh, choosing the right products is crucial. From upholstery cleaners to leather conditioners, having the top car care products for interior cleaning can make a world of difference. Check out this list of top car care products for interior cleaning to keep your vehicle looking its best.

If you’re in the market for a luxurious car with high-end features but don’t want to break the bank, there are affordable options available. These vehicles offer the perfect combination of style, comfort, and performance without the hefty price tag.

Discover the world of affordable luxury cars with high-end features that won’t empty your wallet.