Looking for the best travel insurance for digital nomads? Dive into this comprehensive guide that covers everything you need to know about finding the perfect insurance coverage for your nomadic lifestyle. From understanding the unique needs of digital nomads to tips for maximizing insurance benefits, this guide has got you covered.

Introduction to Travel Insurance for Digital Nomads

Digital nomads are individuals who work remotely while traveling the world, often living in different countries for extended periods. This lifestyle brings unique insurance needs due to the constant movement and potential risks involved. Travel insurance becomes essential for digital nomads to protect themselves financially and medically while on the go.

The Importance of Travel Insurance for Digital Nomads

Travel insurance provides coverage for medical emergencies, trip cancellations, lost luggage, and other unforeseen events that can disrupt a digital nomad’s journey. Without proper insurance, digital nomads may face significant financial losses and challenges in accessing healthcare services in foreign countries.

When it comes to embarking on thrilling adventures, having the best travel insurance for adventure sports is essential to ensure you’re covered in case of any mishaps. Whether you’re into mountain climbing, scuba diving, or skydiving, this type of insurance provides the protection you need.

Check out this link for more information on the best travel insurance for adventure sports.

Challenges in Finding Suitable Insurance Coverage

- Many traditional insurance policies may not cover long-term travel or remote work, leaving digital nomads vulnerable to risks.

- Insurance plans designed for short-term travelers may not provide adequate coverage for digital nomads who move frequently and stay in different locations for extended periods.

- Some insurance providers may exclude coverage for certain activities or destinations commonly encountered by digital nomads, such as adventure sports or high-risk countries.

- Understanding the fine print and exclusions in insurance policies can be challenging for digital nomads, leading to confusion and potential gaps in coverage.

Factors to Consider When Choosing Travel Insurance

When selecting travel insurance as a digital nomad, there are several key factors to consider to ensure you have adequate coverage for your unique lifestyle. From medical emergencies to valuable electronics, here are the important points to keep in mind:

Medical Emergency Coverage

One crucial factor for digital nomads is the coverage for medical emergencies. Unlike traditional travelers who may have a fixed home base, digital nomads are constantly on the move, making it essential to have coverage that extends beyond a specific location. Look for insurance plans that provide global coverage and include medical evacuation in case of serious emergencies.

Coverage for High-Value Electronics and Equipment

Digital nomads rely heavily on their electronic devices and equipment to work remotely. It is important to choose a travel insurance plan that offers coverage for high-value items such as laptops, cameras, and other essential gadgets. In case of theft, damage, or loss, having insurance that can reimburse the cost of these items can be a lifesaver for digital nomads.

Types of Coverage Available

When it comes to travel insurance for digital nomads, there are several types of coverage options available to consider. It’s important to understand the differences between basic travel insurance and specialized digital nomad insurance policies, as well as the inclusion of coverage for remote work-related liabilities.

Basic Travel Insurance vs. Specialized Digital Nomad Insurance

- Basic travel insurance typically covers common travel risks such as trip cancellations, lost luggage, and emergency medical expenses. While this may provide some level of protection for digital nomads, it may not address their unique needs.

- Specialized digital nomad insurance policies are specifically designed to cater to the lifestyle and work habits of digital nomads. These policies may offer coverage for things like equipment protection, cyber security, and liability related to remote work.

- It’s essential for digital nomads to carefully review the coverage options of both basic travel insurance and specialized digital nomad insurance to ensure they have the appropriate level of protection for their specific situation.

Inclusion of Coverage for Remote Work-Related Liabilities

- Many digital nomad insurance policies include coverage for remote work-related liabilities, such as professional indemnity insurance or liability for data breaches.

- This type of coverage is crucial for digital nomads who rely on their laptops and internet connection to work remotely, as it can protect them from financial losses in case of legal claims or cyber attacks.

- Before purchasing a travel insurance policy for digital nomads, it’s important to verify if it includes coverage for remote work-related liabilities and to understand the extent of that coverage.

Best Insurance Providers for Digital Nomads

When it comes to finding the best insurance providers for digital nomads, there are several options to consider. These providers offer unique features tailored to the needs of remote workers and travelers alike. Let’s take a closer look at some of the top insurance providers in this space.

SafetyWing

SafetyWing is a popular choice among digital nomads for its affordable and flexible insurance plans. They offer global coverage, making it easy for nomads to travel to multiple countries without having to worry about changing policies. SafetyWing also provides coverage for COVID-19 related expenses, which is crucial in today’s uncertain times.

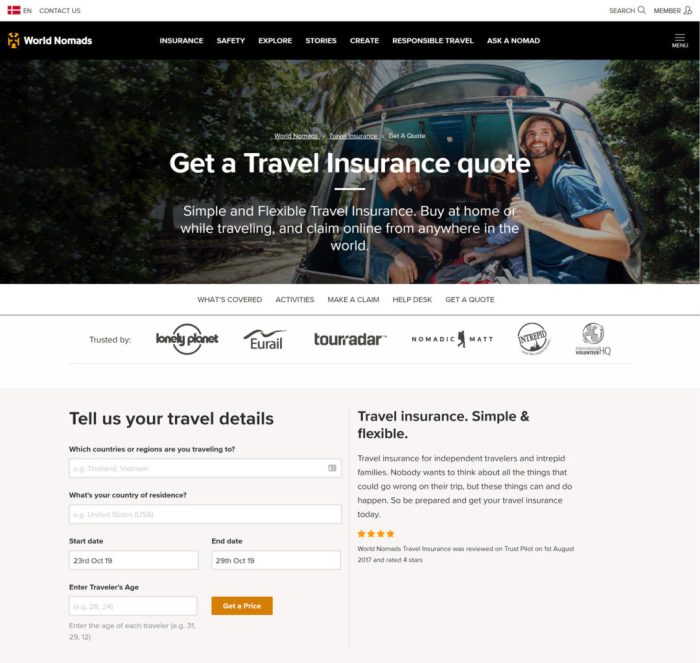

World Nomads

World Nomads is another well-known insurance provider that caters to the needs of digital nomads. They offer a range of coverage options, including emergency medical coverage, trip cancellation, and baggage protection. World Nomads is known for its excellent customer service and quick claims processing, making it a reliable choice for remote workers on the go.

Nomad Insurance

Nomad Insurance is specifically designed for digital nomads and long-term travelers. They offer customizable plans that can be tailored to individual needs, such as coverage for high-risk activities or pre-existing conditions. Nomad Insurance also provides 24/7 emergency assistance, ensuring that nomads have access to support no matter where they are in the world.

IMG Global

IMG Global is a leading provider of international health insurance for expatriates and global citizens. Their plans are ideal for digital nomads who require comprehensive coverage for medical emergencies, evacuation, and repatriation. IMG Global offers flexible policy terms and a wide network of healthcare providers worldwide, making it a top choice for remote workers seeking peace of mind while traveling.

These insurance providers have proven beneficial to digital nomads in various real-life scenarios, from unexpected medical emergencies to travel disruptions. By choosing the right insurance provider that aligns with your needs and travel habits, you can ensure a worry-free and safe experience as you navigate the world as a digital nomad.

Tips for Maximizing Insurance Benefits: Best Travel Insurance For Digital Nomads

When it comes to travel insurance for digital nomads, maximizing your benefits is key to ensuring you are adequately covered while on the go. Here are some tips to help you make the most of your insurance coverage and navigate the claims process smoothly.

Understanding Your Policy Coverage, Best travel insurance for digital nomads

- Read through your policy carefully to understand what is and isn’t covered. Pay attention to any exclusions or limitations that may apply.

- Consider purchasing additional coverage for high-value items such as electronics or equipment that are essential to your work as a digital nomad.

- Keep a copy of your policy documents handy and make sure you have access to them digitally in case of an emergency.

Maintaining Continuous Coverage

- Opt for an annual travel insurance plan rather than single-trip coverage if you are a frequent traveler. This can save you money in the long run.

- Ensure that your insurance policy covers the destinations you plan to visit and any activities you intend to participate in while abroad.

- Renew your policy before it expires to avoid any gaps in coverage that could leave you unprotected during your travels.

Smooth Claims Processing

- Keep detailed records of any medical treatments or expenses you incur while traveling. This will make it easier to file a claim later on.

- Notify your insurance provider as soon as possible in the event of an emergency or if you need to make a claim. Follow their instructions carefully to ensure a smooth process.

- Document any incidents or accidents that occur during your trip, including taking photos and getting statements from witnesses if possible.

Final Wrap-Up

In conclusion, choosing the right travel insurance as a digital nomad is crucial for your peace of mind and protection while on the go. By considering the key factors, exploring different coverage options, and selecting the best insurance provider, you can ensure a worry-free travel experience. Stay safe and travel smart!

Enhance your driving experience with innovative car accessories that can add convenience and style to your daily commute or road trips. From high-tech gadgets to practical organizers, these accessories can make your time on the road more enjoyable. Discover more about these innovative products by visiting innovative car accessories to enhance driving experience.