Delving into Travel insurance coverage for rental cars, this introduction immerses readers in a unique and compelling narrative, with informal but serious style that is both engaging and thought-provoking from the very first sentence.

Traveling is an exciting adventure, but it comes with its own set of risks, especially when it comes to renting cars. Understanding the ins and outs of travel insurance coverage for rental cars is crucial to ensure a smooth and stress-free journey. From navigating coverage details to exploring additional benefits, let’s unravel the complexities of this essential aspect of travel preparation.

Overview of Travel Insurance for Rental Cars

Travel insurance for rental cars is a type of insurance coverage that provides protection for individuals renting vehicles while traveling. It is important because it offers financial security and peace of mind in case of unforeseen circumstances or accidents during the rental period.

Benefits of Travel Insurance for Rental Cars

- Collision Damage Waiver (CDW) coverage can help pay for damages to the rental car in the event of a collision.

- Loss Damage Waiver (LDW) coverage can cover the cost of replacing or repairing a rental car if it is stolen or damaged.

- Liability coverage can protect the renter from being financially responsible for injuries or property damage caused by the rental car.

- Personal Effects coverage can reimburse the renter for personal belongings stolen from the rental car.

Types of Coverage in Travel Insurance Plans for Rental Cars

- Rental Car Damage Coverage: Covers damage to the rental car in case of accidents or theft.

- Liability Coverage: Protects against financial responsibility for injuries or property damage caused by the rental car.

- Personal Effects Coverage: Reimburses for stolen personal belongings from the rental car.

- Emergency Assistance Coverage: Provides assistance in case of emergencies such as breakdowns or accidents.

Coverage Details

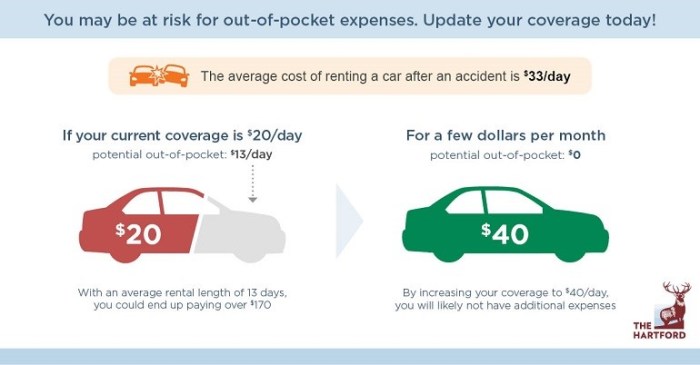

Travel insurance plans for rental cars typically come with specific coverage limits and inclusions to protect travelers in case of accidents or damages to the rental vehicle.

Coverage Limits

- Most travel insurance plans offer coverage limits ranging from $25,000 to $50,000 for damages to the rental car.

- Liability coverage for injuries or damages to third parties is usually capped at around $100,000 to $300,000.

- Some plans may also include coverage for theft of personal belongings from the rental vehicle, with limits up to $1,000.

What is Covered, Travel insurance coverage for rental cars

- Damage to the rental vehicle due to accidents, theft, vandalism, or natural disasters is typically covered by travel insurance.

- Medical expenses for injuries sustained in a car accident while driving the rental vehicle may also be included in the coverage.

- Coverage for towing and roadside assistance services in case of a breakdown or mechanical failure of the rental car.

Exclusions and Limitations

- Insurance plans may not cover damages caused by reckless driving, driving under the influence of alcohol or drugs, or driving on unpaved roads.

- Some insurance policies may have restrictions on the types of rental vehicles covered, such as luxury cars, motorcycles, or RVs.

- Coverage limits may vary based on the country or region where the rental car is being used, so it’s essential to check the policy details carefully.

Additional Benefits

Travel insurance for rental cars often includes a range of additional benefits to enhance your overall travel experience. These benefits can provide peace of mind and convenience during your trip.

Roadside Assistance

Roadside assistance is a common additional benefit offered in many travel insurance plans for rental cars. This service typically covers towing, jump-starts, flat tire changes, and locksmith services in case you lock yourself out of the car. Having roadside assistance can be a lifesaver in unfamiliar locations or in case of unexpected car trouble.

Extended Coverage

Some travel insurance plans may offer extended coverage for rental cars, such as coverage for loss of use charges or additional liability protection. This can be especially beneficial if you plan to drive long distances or in remote areas where the risk of accidents or breakdowns is higher.

When it comes to the fastest sports cars of all time, there are some legendary models that have left a mark on the automotive world. Discover more about these speed demons in our article on the Fastest sports cars of all time and get ready to be amazed by their incredible performance.

Personal Belongings Coverage

Certain travel insurance plans may also include coverage for personal belongings that are stolen or damaged while in the rental car. This can be helpful in case of theft or accidents that result in damage to your personal items, providing financial reimbursement for the loss.

If you’re looking for affordable luxury cars with high performance, look no further than our recommendations. Check out our list of Affordable luxury cars with high performance that offer the perfect blend of style, comfort, and speed.

Emergency Assistance Services

Emergency assistance services are another valuable additional benefit that some travel insurance plans offer. This includes access to a 24/7 helpline for emergencies, medical referrals, and coordination of emergency services in case of accidents or other unforeseen events during your trip.

Rental Car Insurance Options: Travel Insurance Coverage For Rental Cars

When it comes to renting a car, travelers often face the decision of whether to rely on their travel insurance for coverage or purchase insurance directly from the rental car company. Each option has its pros and cons, so it’s essential to weigh them carefully before making a decision.

Travel Insurance for Rental Cars

- Pros:

- Convenience: Travel insurance typically covers rental car damages and theft, saving you the hassle of dealing with multiple insurance policies.

- Cost: Travel insurance may be more cost-effective, especially if you already have a comprehensive policy that includes rental car coverage.

- Cons:

- Limited Coverage: Travel insurance may have restrictions on rental car coverage, such as specific exclusions or lower coverage limits.

- Claim Process: Filing a claim through your travel insurance for rental car damage or theft can be more complicated compared to direct rental car company insurance.

Purchasing Insurance from Rental Car Company

- Pros:

- Comprehensive Coverage: Insurance from the rental car company often provides more extensive coverage options, including additional protections like roadside assistance.

- Simplified Process: Dealing directly with the rental car company for insurance claims can streamline the process and ensure faster resolution.

- Cons:

- Cost: Insurance purchased from the rental car company may be more expensive compared to relying on travel insurance.

- Duplicate Coverage: You may end up paying for coverage that overlaps with what your travel insurance already provides, resulting in unnecessary expenses.

How to Decide on the Best Insurance Option

- Review Your Existing Coverage: Check your travel insurance policy to see if it includes rental car coverage and the extent of that coverage.

- Assess Your Rental Needs: Consider the value of the rental car, the length of your trip, and the potential risks involved to determine the level of coverage you require.

- Compare Costs and Benefits: Compare the cost of purchasing insurance from the rental car company with the coverage provided by your travel insurance to make an informed decision.

Ending Remarks

As we conclude our exploration of travel insurance coverage for rental cars, it’s evident that being informed and prepared can make all the difference in your travel experience. By understanding the nuances of coverage options and additional benefits, you can protect yourself and your rental vehicle effectively, allowing you to focus on enjoying your trip to the fullest.