Travel insurance claim process explained: diving into the intricacies of filing a claim when the unexpected happens while traveling.

From understanding policy terms to submitting claims and documenting losses, we’ve got you covered.

Overview of Travel Insurance Claim Process

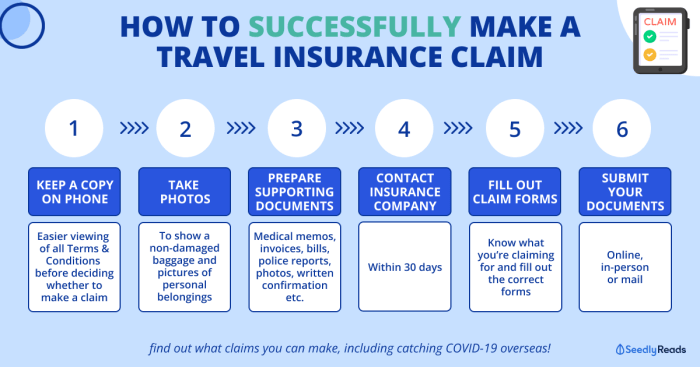

When it comes to filing a travel insurance claim, there are several general steps that you need to follow to ensure a smooth process. First and foremost, it is crucial to understand the terms and conditions of your policy before initiating a claim. This will help you determine what is covered and what documents you need to provide.

Documents Required for Claim Process

- Proof of travel insurance policy

- Copies of all relevant receipts and invoices

- Medical reports or police reports (if applicable)

- Completed claim form provided by the insurance company

- Any other supporting documents requested by the insurer

Importance of Understanding Policy Terms and Conditions

Before filing a travel insurance claim, it is essential to carefully review and understand the policy terms and conditions. This will help you avoid any surprises or misunderstandings during the claims process. Make sure you know what is covered, any exclusions, and the steps required to file a claim. Being informed from the start will make the process much easier and more efficient.

When it comes to senior citizen travel, having the right insurance is crucial. There are various senior citizen travel insurance options available that cater to different needs and budgets. It’s important to choose a plan that provides adequate coverage for medical emergencies and trip cancellations, ensuring a worry-free vacation.

Submitting a Claim

When it comes to submitting a travel insurance claim, it is essential to follow the proper process to ensure a smooth and efficient experience. Here is a breakdown of how to submit a claim for your travel insurance:

Filling out Claim Forms

- Start by carefully reading through the claim form provided by your insurance company. Make sure to understand all the sections and requirements before filling it out.

- Provide accurate and detailed information about your claim, including the date of the incident, the nature of the claim, and any supporting documentation required.

- Double-check all the information filled out in the claim form to avoid any errors that could delay the processing of your claim.

Types of Travel Insurance Claims

- For medical claims: Ensure you have all the necessary medical documents, such as receipts, diagnosis reports, and treatment records, to support your claim.

- For trip cancellation claims: Provide documentation of the reason for cancellation, such as a doctor’s note, airline notification, or any other relevant proof.

- For lost baggage claims: Submit a copy of the baggage claim form from the airline, along with proof of the items lost and their value.

Submitting Within the Specified Timeframe

- It is crucial to submit your travel insurance claim within the specified timeframe mentioned in your policy. Failure to do so might result in your claim being denied.

- Be aware of the deadlines set by your insurance provider and make sure to submit all required documentation well before the deadline to avoid any issues.

- If you need an extension due to unforeseen circumstances, contact your insurance company immediately to discuss your situation and request an extension if possible.

Documenting Losses

When filing a travel insurance claim, it is crucial to provide proper documentation to support your claim. This documentation helps the insurance company assess the validity of your claim and process it efficiently.

Types of Documents Required

- Receipts for expenses related to the incident, such as medical bills, accommodation costs, and transportation.

- Police reports in case of theft, loss, or any criminal activity during your trip.

- Medical records and doctor’s notes if you incurred medical expenses or had to seek medical treatment during your travels.

- Proof of travel arrangements, such as flight tickets, hotel bookings, and tour reservations.

- Insurance policy documents and claim forms provided by your travel insurance provider.

Tips for Organizing and Documenting Losses

- Keep all receipts and documents organized in a safe place during your trip to avoid misplacing or losing them.

- Make copies of all important documents and store them separately from the originals.

- Create a digital backup of your documents by scanning or taking clear photos of them with your smartphone.

- Maintain a detailed record of all expenses incurred due to the incident, including dates, amounts, and descriptions.

- Contact the local authorities, healthcare providers, or relevant parties to obtain additional documentation if needed.

Handling Lost or Unavailable Documents

- If original documents are lost or unavailable, provide copies or alternative forms of documentation, such as bank or credit card statements showing the relevant transactions.

- Submit a written explanation detailing the circumstances of the lost documents and why you are unable to provide them.

- Work with the insurance company to find acceptable alternatives or solutions to support your claim effectively.

Claim Evaluation and Settlement: Travel Insurance Claim Process Explained

When it comes to travel insurance claims, the evaluation and settlement process plays a crucial role in determining the outcome for policyholders. Insurance companies have specific procedures in place to assess the validity of claims and determine the appropriate settlement amount based on various factors.

Evaluation Process

- Insurance companies will review the submitted claim along with all relevant documentation to verify the details of the loss or incident.

- Claims adjusters may conduct further investigations or request additional information to validate the claim.

- The evaluation process also involves assessing the coverage limits of the policy and determining if the claim falls within the scope of the coverage.

Factors Affecting Settlement, Travel insurance claim process explained

- The extent of coverage provided by the policy can greatly impact the settlement amount. Some policies have specific limits or exclusions that may affect the final payout.

- The documentation provided by the policyholder is crucial in determining the settlement. Clear and detailed evidence of the loss or incident can expedite the process.

- The cause of the claim, such as natural disasters, medical emergencies, or trip cancellations, can also influence the settlement amount based on the policy terms.

Timelines for Evaluation and Settlement

- Insurance companies typically aim to evaluate and settle claims within a reasonable timeframe, which can vary depending on the complexity of the claim.

- Simple claims with clear documentation may be processed more quickly, while complex claims or those requiring further investigation may take longer to settle.

- Policyholders should stay in communication with their insurance company throughout the process to ensure timely updates on the status of their claim.

Summary

Navigating the travel insurance claim process doesn’t have to be daunting. With the right knowledge and preparation, you can ensure a smooth experience and get the coverage you deserve.

Regular car engine tune-ups are essential to keeping your vehicle running smoothly and efficiently. By scheduling regular tune-ups , you can prevent costly repairs down the line and improve fuel efficiency. Don’t overlook the importance of maintaining your car’s engine for safe and reliable driving.